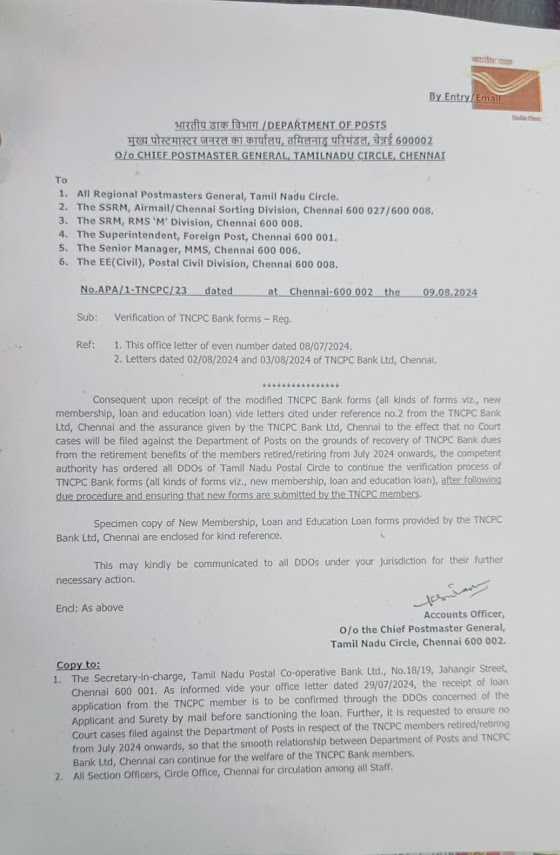

Verification of TNCPC Bank Forms: TN Circle Instruction Dated 09/08/2024

On August 9, 2024, the Tamil Nadu Circle issued a crucial instruction regarding the verification of TNCPC (Tamil Nadu Central Processing Centre) Bank forms. This directive aims to streamline and enhance the accuracy of the form verification process, ensuring that all submissions adhere to the established standards and protocols. Below is a comprehensive overview of the key points outlined in the instruction and its implications for stakeholders.

Background

The TNCPC plays a pivotal role in processing banking transactions and financial documentation for the Tamil Nadu Circle. With the increasing volume of transactions and the need for precise data handling, it became necessary to reinforce the verification process for bank forms to maintain high standards of efficiency and accuracy.

Key Points of the Instruction

- Purpose and Scope:

- The instruction focuses on standardizing the verification procedures for bank forms processed through TNCPC.

- It applies to all forms related to financial transactions, including but not limited to account opening, loan applications, and transaction requests.

- Verification Checklist:

- The instruction mandates a detailed checklist to be followed during the verification process. This checklist includes verifying the authenticity of the forms, cross-checking details with supporting documents, and ensuring compliance with regulatory requirements.

- Specific attention is given to the verification of signatures, dates, and personal details to prevent fraud and errors.

- Training and Responsibilities:

- Designated personnel responsible for verification must undergo mandatory training to familiarize themselves with the new procedures.

- The instruction highlights the responsibilities of both the bank staff and TNCPC officials in adhering to these guidelines and maintaining the integrity of the verification process.

- Technology Integration:

- The use of technology and digital tools for verification is encouraged to enhance accuracy and efficiency.

- TNCPC is required to implement updated software solutions that can support the new verification standards and facilitate smoother processing of forms.

- Reporting and Compliance:

- Banks are instructed to report any discrepancies or issues encountered during the verification process to TNCPC promptly.

- Compliance with the new instruction is mandatory, and periodic audits will be conducted to ensure adherence to the updated verification procedures.

- Implementation Timeline:

- The instruction provides a timeline for the full implementation of the new verification procedures. All banks and processing centers are expected to adapt to these changes by the end of the current quarter.

Implications for Stakeholders

For Banks:

- Banks will need to update their internal processes and train their staff to align with the new verification standards.

- There will be an initial adjustment period as banks integrate the new procedures and technology into their operations.

For TNCPC:

- The TNCPC will oversee the implementation of the instruction and provide support to banks during the transition.

- The center will also be responsible for monitoring compliance and addressing any challenges that arise during the implementation phase.

For Customers:

- Customers can expect a more reliable and secure process for handling their banking forms, with reduced chances of errors and fraud.

- The streamlined verification process should lead to quicker resolution times for their banking requests.

Conclusion

The Tamil Nadu Circle’s instruction dated August 9, 2024, on the verification of TNCPC bank forms marks a significant step towards enhancing the accuracy and efficiency of financial documentation processing. By adhering to the outlined guidelines and leveraging technological advancements, banks and TNCPC can ensure a more secure and reliable banking experience for customers. The successful implementation of these instructions will be crucial in maintaining the integrity of financial operations within the Tamil Nadu Circle.