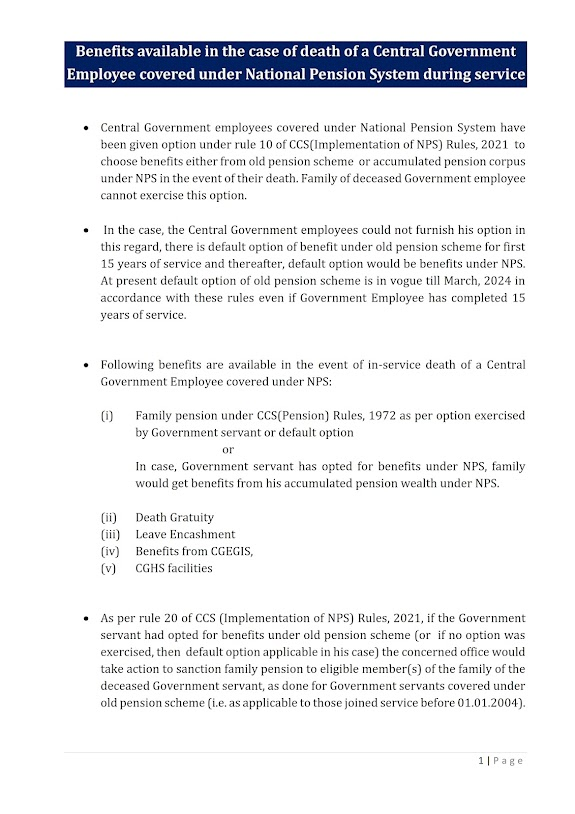

Benefits Available in the Case of Death of a Central Government Employee Covered Under National Pension System

The National Pension System (NPS) is a progressive pension scheme designed to ensure a secure financial future for employees of the Central Government. In the unfortunate event of a Central Government employee’s death while still in service, the NPS provides a range of benefits aimed at supporting the bereaved family and ensuring their financial stability. This article explores the benefits available under the NPS in such circumstances, highlighting the measures in place to offer support and security during a time of loss.

Source : https://pensionersportal.gov.in/Document/NPS_TerminalBenefits_InServiceDeath.pdf

Overview of the National Pension System (NPS)

The NPS is a voluntary, defined contribution pension system, where employees contribute to their pension fund, which is managed by professional fund managers. Upon retirement or in case of an unfortunate event such as death, the accumulated corpus is utilized to provide financial support to the employee or their family.

Key Benefits for the Family of a Deceased NPS-Registered Employee

- Death Benefit to Nominees Overview:

- In the event of an employee’s death, the NPS ensures that the accumulated corpus is transferred to the nominated beneficiaries. This benefit provides immediate financial support to the family. Process:

- The nominee(s) must submit a claim along with the death certificate, a copy of the deceased’s NPS account details, and any other required documents to the Central Recordkeeping Agency (CRA) or the concerned NPS authority.

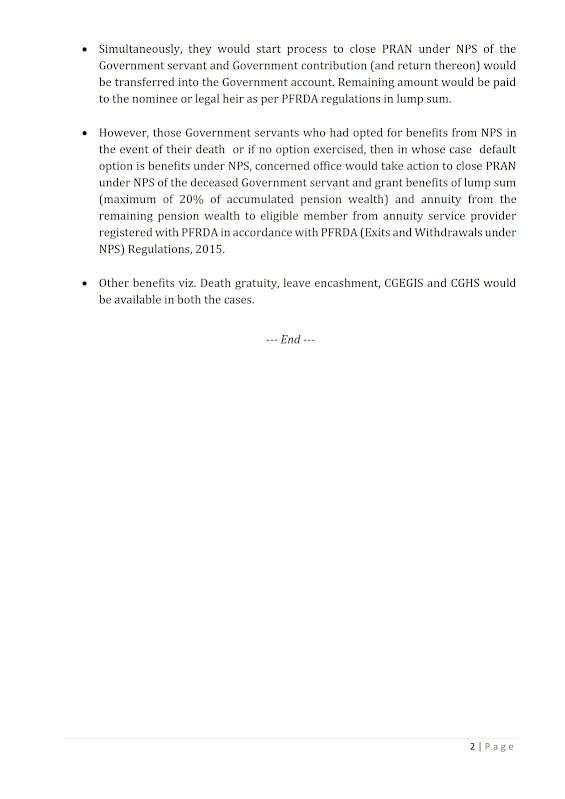

- Lump Sum Payment Overview:

- Upon the death of the employee, the NPS corpus can be withdrawn as a lump sum payment by the nominees. This lump sum amount includes the contributions made by the employee along with the accrued returns. Eligibility:

- Nominees or legal heirs are entitled to receive the entire corpus if the employee passes away before retirement. The lump sum payment provides a substantial financial resource to the family. Taxation:

- As per the regulations, the lump sum payment is generally tax-free up to a certain limit, ensuring that the family receives the full benefit without the burden of taxation.

- Family Pension Overview:

- If the deceased employee was covered under the NPS and had opted for an annuity plan, the family might be eligible for a family pension. This pension is designed to provide a steady income stream to the spouse or dependent children of the deceased. Process:

- The family needs to apply for the annuity plan benefits by submitting the necessary documents to the annuity service provider or the NPS authorities.

- Accrued Returns Overview:

- The NPS fund, managed by professional fund managers, generates returns on the contributions made by the employee. In the event of death, the accrued returns on the contributions are added to the total corpus payable to the family. Details:

- The returns are calculated based on the performance of the NPS investment funds, and the total amount payable reflects both the contributions and the returns earned over time.

Process of Claiming Benefits

- Documentation:

- The family or nominees need to prepare and submit various documents, including the death certificate, proof of identity, NPS account details, and any other documents required by the NPS authorities.

- Claim Submission:

- Claims can be submitted to the Central Recordkeeping Agency (CRA), the Pension Fund Regulatory and Development Authority (PFRDA), or the concerned NPS authority. The process involves filling out claim forms and providing all necessary supporting documents.

- Processing and Disbursement:

- Upon receipt of the claim, the authorities will verify the documents and process the claim accordingly. The lump sum payment, family pension, or other benefits will be disbursed to the nominee(s) or legal heirs.

Additional Support Measures

- Financial Counseling: Some NPS authorities offer financial counseling and support to help families navigate the process and make informed decisions regarding their benefits.

- Help Desks: Dedicated help desks or support teams are available to assist families with queries and provide guidance throughout the claim process.

Conclusion

The National Pension System provides a robust safety net for the family of a Central Government employee in the unfortunate event of their death during service. Through benefits such as lump sum payments, family pensions, and the inclusion of accrued returns, the NPS ensures that the financial needs of the bereaved family are met with dignity and support. Understanding these benefits and the process to claim them is crucial for families to access the assistance they are entitled to, honoring the legacy and service of their loved one with the security and care they deserve.